- Original article

- Open access

- Published:

Term structure dynamics at low and negative interest rates—evidence from Switzerland

Swiss Journal of Economics and Statistics volume 154, Article number: 20 (2018)

Abstract

This paper studies the transmission of changes in short-term interest rates to longer-term government bond yields when interest rates are at very low levels or negative. We focus on Switzerland, where short-term interest rates have been at zero since late 2008 and negative since the beginning of 2015. The expectations hypothesis of the term structure implies that as nominal interest rates approach their lower bound, the effect of short-term rates on longer-term yields should decline, and positive short rate changes should have larger absolute effects than negative short rate changes. Contrary to studies of other countries, we find no evidence for a decline in the effect of short rate changes for the low-interest rate period using Swiss data. However, we do find evidence for the predicted asymmetric effect for positive and negative short rate changes during the period when short-term rates are close to zero. This asymmetry normalized again after the introduction of negative interest rates.

Introduction

In the past few years, several central banks have moved their policy rates into negative territory. The Danish central bank first introduced a moderately negative deposit rate of − 0.05% in 2012.Footnote 1 The European Central Bank gradually reduced its deposit rate into negative territory starting in 2014, leading to a deposit rate of − 0.4% in March 2016. The Swiss National Bank (SNB) introduced negative interest rates on sight deposit account balances of − 0.75% in January 2015 and thus pioneered cutting policy rates much deeper into negative territory. Denmark and Sweden have since followed suit with similar sized cuts. And after more than 7 years of holding short-term interest rates at zero, the Bank of Japan cut its main policy rate to − 0.1% in January 2016. Bech and Malkhozov (2016) analyzed the rate cuts into negative territory by the four European central banks and found that the transmission of modestly negative policy rates to money market rates works the same way as with positive interest rates.

An important question for central banks is how short rate changes are transmitted to longer-term yields, which are relevant for consumption and investment decisions. What makes the transmission mechanism at very low interest rates special is the presence of a lower bound on nominal interest rates. This lower bound has implications for the relationship between short- and long-term interest rates, even when rates are still above the lower bound. Ruge-Murcia (2006) used a simple term structure model to show that when nominal interest rates are constrained by some lower bound, the expectations hypothesis of the term structure implies a nonlinear relationship between changes in short-term interest rates and changes in longer-term yieldsFootnote 2. As short rates approach the lower bound, (1) the effect of short rates on longer-term yields declines and (2) the effect of short rates on longer-term yields becomes increasingly asymmetric, with short rate increases having a larger absolute impact than short rate declines. These effects work through market expectations of future short-term interest rates. The closeness to the lower bound influences the distribution of likely future changes in the policy rate, and hence long-term interest rates. Because market participants anticipate that future short rate shocks are constrained by the lower bound on nominal interest rates, expected future short rates and the yield curve are effected even when short rates are still above the lower bound. When short rates are closer to the lower bound, a short rate decline will produce a smaller downward shift in expected future short rates and thus also a smaller effect on long-term yields.

This paper investigates how changes in short-term interest rates transmit to longer-term interest rates when the policy rate is at very low levels or negative. For this empirical analysis, data for Swiss franc short- and long-term interest rates are used. Switzerland is an interesting case study for our purposes because the SNB has lowered interest rates further than any other central bank. If the effective bound on nominal interest rates is the same across countries, then one could argue that Swiss interest rates are closest to what constitutes an “effective lower bound”. Therefore, if the nonlinearities predicted by term structure models such as Ruge-Murcia (2006) are important in practice, it should be possible to detect them in the Swiss term structure. Our empirical approach follows Ruge-Murcia (2006) and Grisse (2015): we regress daily changes in long-term bond yields on positive and negative changes in short-term interest rates. To allow the strength of the comovements between short- and long-term interest rates to depend on the interest rate level, we estimate this regression separately for four sub-samples.

The results can be summarized as follows. In the pre-crisis sample, which lasts until the lower bound of the target range for the Swiss National Bank (SNB) for the Swiss franc 3-month Libor reaches zero, we find no statistically significant difference between the impacts of negative and positive short rate changes on long-term interest rates. As short rates turn lower, the effect of short rate increases rises, while that of short rate decreases remains stable, contrary to what theory predicts.

During the minimum exchange rate regime of the SNB, the impact of positive changes in short-term rates drops and loses statistical significance, but it rises again after the introduction of negative interest rates. Hence, the impact with negative interest rates is less asymmetric for positive versus negative short rate changes than at times when the policy rate was at the zero lower bound. This finding shows that the transmission from short-term to long-term interest rates normalized after the introduction of negative interest rates, perhaps because that introduction was associated with a decline in the market-perceived lower bound. While the previous literature has found that the transmission to longer-term interest rates is impaired when the policy rate is close to its perceived lower bound, we find that this has not been the case in Swiss data. It also suggests that market participants changed their beliefs about the level of the effective lower bound and do not consider the effective lower bound to have been reached yet at the current policy rate of − 0.75%.

In this paper, we look at the general daily correlation between short- and long-term interest rates, rather than at the transmission of policy rate changes. Nevertheless, our findings are suggestive of the following important policy implications for the use of negative interest rates as a monetary policy tool. First, the empirical results suggest that a move of policy interest rates into negative territory not only transmits well to money market interest rates, but also to longer-term interest rates such as government bond yields. Second, the results for the zero lower bound period are consistent with the asymmetric effects of positive and negative short-rate changes that are predicted by the Ruge-Murcia (2006) model. As short rates are normalized after a period close to the lower bound, positive changes in the short term rate may have unusually strong effects, and long-term yields may adjust very quickly to changes in the policy rate.

The remainder of this paper is structured as follows. The “Swiss monetary policy implementation” section summarizes the developments in the implementation of monetary policy in Switzerland since the global financial crisis. The “Theoretical motivation” section presents a summary of the Ruge-Murcia (2006) model that motivates the empirical analysis and discusses its applicability in periods when the central bank intervenes on the FX market. The “Empirical analysis” section presents the empirical analysis of the effects of Swiss franc short-term on long-term interest rates, and the “Robustness” section provides several robustness checks. Finally, the “Conclusions” section concludes.

Swiss monetary policy implementation

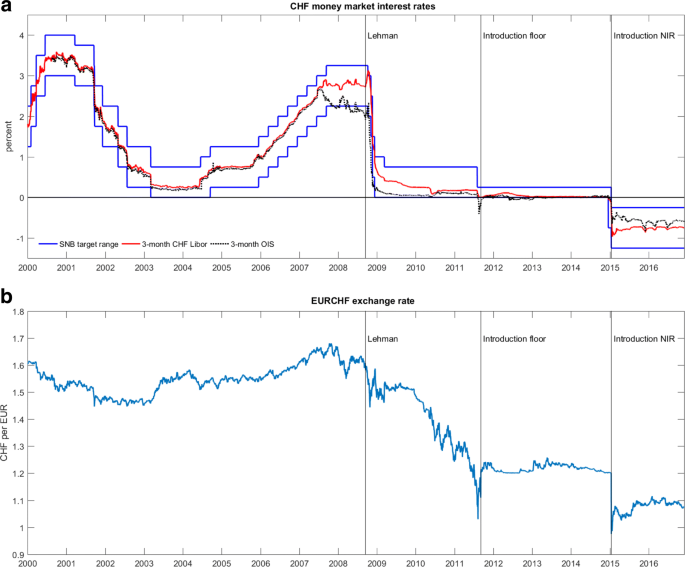

The cornerstone of Swiss monetary policy strategy is an announced target band for the level of the market-determined 3-month Swiss franc interbank interest rate, the 3-month Libor. The announced target band is chosen to be consistent with an outlook for the medium-term inflation rate of below 2%. Before the financial crisis, the SNB implemented its strategy using as its main tool the interest rate on 1-week repo liquidity providing operations with its counterparties to steer short-term money market interest rates toward the announced target band. The 1-week repo rate was adjusted frequently to keep the 3-month Libor rate close to the middle of its announced target band. Panel (a) of Fig. 1 shows the evolution of Swiss money market interest rates since 2000.

Monetary policy implementation changed as Switzerland was affected by the global financial crisis in 2008–2009. Because of adverse financial as well as real shocks and an unprecedented appreciation of the Swiss franc linked to its safe haven status (see panel (b) of Fig. 1), the outlook for Swiss economic activity and inflation worsened abruptly.

As a response, the SNB lowered its mid-point of the target band for the 3-month Libor gradually starting in the second half of 2008, reaching 0.50% in the first half of 2009. In 2009, the SNB introduced new and unconventional monetary policy instruments. In March 2009, a small asset purchase program was announced and carried out. Moreover, an implicit ceiling for the strength of the Swiss franc against the euro was announced and enforced through foreign exchange interventionsFootnote 3. The continuing persistent pressure on the Swiss franc culminated in a series of liquidity expansions in August 2011 and the introduction of a minimum exchange rate against the euro in September 2011Footnote 4. The minimum exchange rate policy was in place until January 2015.

Through these various unconventional measures, the resulting liquidity surplus of the SNB counterparties grew immensely between 2009 and 2015. As a result, the liquidity in the Swiss money market, especially in the unsecured market, fell dramatically during those years as banks became satiated in liquidity (see Guggenheim et al. 2011). The SNB’s liquidity-providing repo operations were suspended for roughly a year in May 2010 and finally discontinued in April 2012Footnote 5.

The SNB’s tools for monetary policy implementation during the period of March 2009 to January 2015, namely liquidity-providing asset purchases and foreign exchange interventions, also affected long-term interest rates through term and risk premiums (Christensen and Krogstrup 2016). The measures did, however, also succeed in affecting the 3-month Swiss franc Libor rate within its target band, and this variation is what we take advantage of in our empirical analysis. Notably, the unprecedented liquidity expansions of August 2011 succeeded in pushing the 3-month Libor along with other money market interest rates to near zero, reflecting the easing effect of the measures taken. To control for the effect of unconventional monetary policy and the large expansion of the SNB’s balance sheet, we will include the changes in the total of banks’ sight deposits held at the SNB.

Inflation perspectives worsened anew in Europe starting in mid-2014, resulting in a further loosening of the ECB’s monetary policy stance and renewed pressures on the Swiss franc. On December 18, 2014, the SNB announced a lowering of the target range for 3-month Libor into negative territory of − 0.75% to 0.25%. This was the first time that the mid-point of the SNB’s target range for the 3-month Swiss franc Libor became negative. To achieve this lowering of short-term money market rates into negative territory, the SNB introduced negative interest on banks’ sight deposits held by the SNB (the equivalent of central bank reserves) and simultaneously announced that it would be set at − 0.25%. The change was only to come into effect on January 22, 2015, because of a required change in the terms of business with the SNB’s counterparties. On the 15th of January 2015, however, at the same time as the announcement of the exit from the minimum exchange rate regime, interest rates on sight deposits were further lowered to − 0.75%, again taking effect on January 22, 2015. The target range for the 3-month Libor was further lowered to − 1.25% from − 0.25%. From January 2015 onward, the SNB’s main tool for monetary policy implementation was again a short-term interest rate. At the same time, the SNB continued to emphasize its willingness to be active in the foreign exchange market as necessary.

Swiss franc money market rates reacted significantly to the introduction of negative interest rates. The response of the 3-month Swiss franc Libor to the announced lowering into negative of the target band was immediate, as shown in Fig. 2. Additionally, the future contracts on the 3-month Swiss franc Libor as well as the 3-month fixed rate for overnight indexed swaps (OIS), SARON, the overnight rate for secured Swiss franc liquidity and the 3-month treasury bill rate reacted consistently and have since then been within the SNB’s target range. Thus, the transmission of the change in the policy rate to money market interest rates worked well. Long-term interest rates also reacted immediately to the two announcements. In particular, on the 15th of January 2015, long-term interest rates fell within a few minutes by 20 to 30 basis points. Swiss government bond yields of horizons up to 10 years turned negative in January 2015, with 5-year yields falling to − 1% and 10-year yields falling as far as − 0.3% (see Fig. 3), suggesting a strong transmission to long-term yields. The announcements of rate cuts into negative territory likely moved market perceptions of where the lower bound on interest rates is located, as well as simultaneously lowering the policy rate. Moreover, the simultaneous discontinuation of the minimum exchange rate policy resulted in strong upheaval in global financial markets. Long-term interest rates may have responded to all of these factors at that event. As we wish to separately identify the effect of the policy rate, we add dummies for these particular events to the time series regressions below.

Theoretical motivation

We use the model of Ruge-Murcia (2006) as a theoretical framework for analyzing the transmission of short-term interest rates to longer-term rates. This is a simple shadow rate term structure model consisting of three equations. First, nominal interest rates are constrained by a lower bound: the short-term rate is equal to the “shadow interest rate” if that rate is above the lower bound and is equal to the lower bound otherwiseFootnote 6. When the lower bound is binding, the shadow interest rate is unobserved. Second, the shadow rate follows an autoregressive process. Third, longer-term yields are equal to average expected future short rates (the expectations hypothesis) plus a term or liquidity premium. The model admits an analytical solution if one assumes a simple autoregressive process and normally distributed shocks for the shadow short rate equation. Simulations show that the insights from this analytical solution generalize to more general stochastic processes for the shadow short rate.

The model predicts that when nominal interest rates are constrained by a lower bound, the expectations’ hypothesis of the term structure implies a nonlinear relationship between changes in short-term interest rates and changes in longer-term yields. As short rates approach the perceived lower bound, (1) the effect of changes in short-term interest rates on changes in long-term yields declines and (2) the effect of changes in short-term interest rates on long-term yields becomes increasingly asymmetric, with positive changes in short-term interest rates exhibiting a larger absolute impact than negative changes.

The intuition for these results is as follows. Suppose markets view future positive and negative interest rate shocks as equally likely. Furthermore, suppose that short-term rates are at 0.5% and that the market-perceived lower bound is zero. While a future shock to the shadow short rate of + 1 percentage points would raise short rates to + 1.5%, a shock of − 1 percentage points would only lower short rates to zero. Market participants anticipate that the effects of future shocks on short rates are constrained by the lower bound on nominal interest rates in this way. Therefore, expected future short rates and the yield curve are affected by the presence of the lower bound, even in an environment where short rates are still positive. As short rates move closer to the lower bound, a short rate decline will result in a smaller downward shift in expected future short rates and therefore also a smaller drop in long-term yields.

Ruge-Murcia (2006) estimates his model using Japanese data, and other studies have more recently looked at US data (e.g., Grisse (2015)). These studies find that the transmission of declines in short-term interest rates to the rest of the term structure becomes weaker as nominal rates approach zero. There are no previous studies using negative nominal rates, because sufficiently long time series with negative policy rates have not previously been available. The recent Swiss experience with negative policy rates since January 2015 gives us the opportunity to study the relationship between short- and long-term interest rates when nominal rates are well below zero.

One shortcoming of the Ruge-Murcia model, as well as of related term structure models, is the implicit assumption that the short-term interest rate is the only monetary policy instrument, and that all information that is relevant for long-term bond yields is contained in short-term interest rates. Because of this assumption, the model may not be a good description of term structure dynamics in periods where the central bank affects long-term bond yields directly via communication (for example through forward guidance) or through purchases of long-term bonds (quantitative easing). However, in contrast to other major central banks, the SNB has not employed forward guidance or domestic quantitative easing to influence long-term yields. Instead—as discussed in the “Swiss monetary policy implementation” section—the SNB used unsterilized foreign exchange interventions to counter appreciation pressure on the Swiss franc. Does the Ruge-Murcia model apply to such an environment? How do unsterilized FX interventions affect the mechanics of term structure models?

It is possible that large FX interventions were interpreted by markets as suggesting that the SNB was likely to keep policy rates low for longer. To the extent that this was the case, short rates would have been unchanged (anchored at the policy rate) while long rates would fall. Such signaling effects are not accounted for in the Ruge-Murcia framework. In the empirical application, with little variation in short-term rates during periods of very low interest rates, this effect could have reduced the correlation between short- and long-term interest rates.

The SNB was intervening on the foreign exchange market to counter appreciation pressure on the Swiss franc. To the extent that such appreciation pressure was driven by safe-haven effects—with investors rebalancing their portfolios towards perceived safe assets, including Swiss franc denominated assets in general and Swiss government bonds in particular—increases in SNB reserves due to the SNB’s FX interventions might have been correlated with declines in CHF interest rates. Such “safe-haven demand” effects are not accounted for in simple term structure models. They would have tended to move short- and long-term interest rates in the same direction. To the extent that safe-haven effects are more important for longer-term bonds than for the money market (with investors rebalancing more towards longer-term bonds), they would result in a decline of the term premium (which in the Ruge-Murcia framework is an exogenous shock). Overall, then, it is possible that during the low-interest-rate period in Switzerland, safe-haven effects might have led to an increase in the correlation between negative changes in short- and long-term interest rates, with long rates falling more strongly than short rates.

Unsterilized FX interventions are associated with increases in central bank reserves held by banks. The SNB implemented negative interest rates by charging banks interest on those reserves that exceeded certain exemption thresholds. For the banking system as a whole, the exemption threshold thus became more binding as SNB reserves grew. This should have increased the transmission of the negative policy rate to short-term interest ratesFootnote 7. One might therefore expect that unsterilized FX interventions were associated with declines in short-term interest rates. However, as discussed above (see panel (a) of Fig. 1), short-term rates were well anchored to the policy rate throughout the period that we study, and in particular also after the introduction of the negative policy rate. Therefore, the effect of the SNB’s FX interventions on short-term CHF interest rates is likely to have been small. To the extent that this effect is present and the resulting decline in short-term rates is persistent, it would be transmitted to longer-term interest rates through the standard expectations channel captured in the Ruge-Murcia model.

Finally, Christensen and Krogstrup (2015) argue using a theoretical model that the expansion in central bank reserves associated with unsterilized FX interventions lowers long-term yields via portfolio balance effects. To the extent that this mechanism is quantitatively important, this would correspond to a decline in the term premium and thus potentially (with unchanged short-term interest rates) to a reduced correlation between short- and long-term interest rate changes.

Empirical analysis

In the following, we investigate empirically whether the transmission of short-term interest rate movements to longer-term yields changes when interest rates are close to zero or negative. The experience with negative policy rates in recent years in Switzerland lends itself particularly well to investigating these effects. Interest rates in Switzerland have been close to zero for a substantial period of time, and they have been negative since late 2014. This makes Switzerland an ideal case study for detecting the nonlinearities predicted by the Ruge-Murcia (2006) model. Moreover, to the best of our knowledge, Swiss data are previously unexplored for these purposes.

The empirical approach we take is an adaptation of the time series approach of Ruge-Murcia (2006) and Grisse (2015) to the specific Swiss circumstances. Using time series regression techniques, we assess the association between the Swiss short-term interest rate, as a measure of the policy rate, and long-term interest rates. To capture the nonlinearities predicted by the model, we allow this association to depend on the level of the short-term interest rate—in the baseline specifications, this is achieved by splitting the sample into different subsamples (pre-zero lower bound (ZLB), ZLB and negative interest rate (NIR) period)—and we allow it to differ depending on whether the short-term interest rate is increasing or declining.

Baseline time series regressions

Our empirical approach follows the work by Ruge-Murcia (2006) for Japanese bond yields (1995–2001) and by Grisse (2015) for the US term structure (1990–2014). Our baseline regression is

Here, ΔRt denotes changes in long-term interest rates, Δrt denotes changes in short-term interest rates, and  is an indicator function to differentiate between positive and negative changes in the short-term interest rate. According to the model, both β1 and β2 are expected to be positive: long-term yields should move in the same direction as short-term interest rates, reflecting the expectations hypothesis of the term structure.

is an indicator function to differentiate between positive and negative changes in the short-term interest rate. According to the model, both β1 and β2 are expected to be positive: long-term yields should move in the same direction as short-term interest rates, reflecting the expectations hypothesis of the term structure.

As discussed in “Theoretical motivation” section, standard term structure models suggest that as nominal interest rates approach the lower bound, the average size of both β1 and β2 should decline, while β1 is expected to become increasingly larger than β2. To investigate whether this effect predicted by the theory is present in the data, we estimate regression (1) and compare the coefficients for four sub-samples: a reference period where policy rates are well above zero; a zero lower bound (ZLB) period where policy rates are close to zero; the floor period where the SNB enforced a minimum exchange rate for the Swiss franc against the euro; and the negative interest rate (NIR) period. Based on the theory, we expect to find that β1>β2 across subsamples, and that β1 and β2 are both larger in the reference period than in the later subsamples where interest rates were close to their effective lower bound. The effective lower bound might have changed in the low-interest rate period, and in particular with the introduction of negative interest rates. Therefore, it is not clear how the magnitude of the coefficients should change between the ZLB, floor and NIR periods.

Swanson and Williams (2014) and Grisse (2015) use 1990–2000 as their reference sample in related empirical work on US data. Because of limited data availability and changes in the SNB’s monetary policy framework between 1999 and 2000, our sample starts on 1 January 2000. Our reference period includes the time period when the SNB’s 3-month target range was above zero, i.e., the days before 11 December 2008, with the exception of the period between 7 March 2003 and 16 April 2004. The days between 7 March 2003 and 16 April 2004, together with the period of 12 December to 2 August 2011, are used in the ZLB period. During this time period, the target range was set to 0–1%, and short-term interest rates fluctuated slightly above zero (see Fig. 1). The minimum exchange rate (floor) period used in the model lasts from 3 August 2011 until 17 December 2014. As of 3 August 2011, the SNB narrowed the target range, lowered the upper bound to 0.25% and intended to increase the banks’ sight deposits to CHF 80 bnFootnote 8. Consequently, money market interest rates declined towards zero. Approximately one month later, the SNB introduced the floor for the Euro-Swiss franc exchange rate. On 18 December 2014, the SNB announced the introduction of negative interest rates on sight deposits. This event starts the NIR sample period, which lasts until the end of our sample (31 March 2017).

Which interest rate should be used as short-term interest rate rt in regression (1)? The natural choice seems to be the SNB’s policy rate, the 3-month Swiss franc Libor. Libor is a trimmed mean of the rates at which eleven panel banks are able to borrow in Swiss franc in the London interbank market prior to 11 a.m. London timeFootnote 9. However, using Libor in regression (1) has several drawbacks. Libor represents the prices for unsecured interbank funding and thus includes a risk premium. For a long time, the risk premia were close to zero. However, during the global financial crisis, the risk premium for unsecured funding increased heavily, and the Libor rates increased accordingly. Moreover, the fixing of the Libor rates as of noon central European time complicates its use in (1), as data for long-term yields ΔRt are usually available per end-of-day. Because of the risk premia included in the Libor rates and the time of the fixing, we chose not to use the Libor rates as explanatory variable. Instead, we use as the independent variable the 3-month OIS rate, which is the fixed rate in an interest rate swap with an overnight rate as floating leg. In a 3-month Swiss franc OIS, for example, the counterparty pays the overnight rate TOIS-fixing during 3 months and receives the fixed 3-month OIS rate in exchange. The OIS rate can be considered as a risk-free interest rate, as no principal is exchanged. Moreover, the 3-month OIS incorporates the expected outcome of the SNB’s next monetary policy assessment, as policy meetings regularly take place four times a year. In contrast to very short-term money market rates, the 3-month OIS is not driven by short-term liquidity management considerations by banks, as is the case for overnight and one-week interest rates. We use the so-called last prices available on Bloomberg for OIS rates, usually traded at approximately 5 p.m. Central European Time (CET).

As long-term interest rates, we use Swiss government bond yields, also referred to as Swiss Confederation bond yields. Currently, outstanding Swiss government bonds are worth CHF 77 bn (including own tranches issued), which amounts to approximately 12% of Switzerland’s GDP. The Swiss confederation has the highest credit rating, and yields on its bonds can be considered a good proxy for nearly risk-free long-term interest rates. We use yields of bonds with a constant time to maturity of 2, 5, 7, 10, 15, and 20 years, available on Bloomberg on an end-of-day basis (last prices, usually traded between 5 and 6 p.m. CET).

Results

Table 1 shows the results for the baseline regression across the four sample periods. The results for the reference period, where interest rates were well above the lower bound, can be summarized as follows. Both coefficients are positive and well below one: as expected long-term bond yields tend to move in the same direction as short-term rates, but not one-for-one. This is in line with the expectations hypothesis of the term structure. The coefficients are typically smaller for longer maturities of the yields used as the dependent variable. Hence, short-term interest rates have a higher impact on shorter term government bond yields, which is consistent with the findings for US data in Grisse (2015). The null hypothesis that the coefficients on positive and negative short rate changes are equal cannot be rejected, which is intuitive as the non-linearities induced by the presence of the lower bound on nominal interest rates are not important when interest rates are well above that lower bound.

In the ZLB period, the coefficients on both positive and negative changes in short-term interest rates increase relative to the reference period—contrary to the predictions of Ruge-Murcia (2006), and at odds with the findings of Grisse (2015) for the USA. The effect of positive short rate changes increases more strongly than that of negative short rate changes. Quantitatively, the resulting asymmetry is much larger than suggested by the results of Swanson and Williams (2014) and by the simulations in Ruge-Murcia (2006). However, the null hypothesis that these coefficients are equal cannot be rejected.

In the floor period, the effect of positive short rate changes on long-term yields becomes negative but—with the exception of using 2-year yields—also insignificant. In contrast, negative short rate changes still exhibit a significant link with long-term yields, even though interest rates are already close to zero. This may be because negative interest rates were considered by market participants as a potential tool for the SNB to reduce the pressure on the Swiss franc, which is in line with the fact that at certain times during the minimum exchange rate regime, future contracts for 3-month Libor futures implied negative Libor rates. Thus, although interest rates were close to zero, they may have still been some distance away from the market-perceived lower bound. With \(\hat {\beta }_{1}\) negative (but close to zero) and \(\hat {\beta }_{2}\) positive and significant, the null hypothesis that β1=β2 can be rejected for most maturities—but for different reasons than suggested by the theory: as discussed in the “Theoretical motivation” section, based on theory, we would have expected β1>β2.

In the NIR period, the impact of positive short-rate changes on long-term yields normalizes again. Contrary to the predictions of the theory, both β1 and β2 are larger than in the reference period. The R2 of the regression rises considerably relative to the earlier periods. Again, the fact that the coefficients for negative changes remain statistically significant suggests that market participants expect short-term interest rates not to have reached the effective lower bound, which is in line with occasionally very negative 3-month Swiss franc Libor futures (as low as − 1.2%) after the introduction of negative interest rates. Market participants might also have changed their expectations about how long interest rates will stay at low levels.

Overall, these findings are mostly hard to reconcile with the predictions of standard shadow rate term structure models. One potential explanation is that our regression framework may not be well suited to describe term structure movements during the periods where the SNB was active on the FX-market. Regression (1) is motivated by the idea that the central bank conducts monetary policy through changes in short-term interest rates, which then transmit to longer-term yields. In recent years, however, SNB monetary policy was marked by interventions on the foreign exchange market. This change in policy regime could have affected the relationship between short- and long-term interest rates, as discussed in “Theoretical motivation” section. To control for the effects of increases in liquidity due to FX interventions, one possibility is to include changes in SNB sight deposits as an additional variable in the regression. However, in the robustness checks below we find that this does not resolve the puzzle.

How, then, can we interpret these findings? Here, we offer a potential, albeit speculative, interpretation of the results. First, we find that coefficients increase in the ZLB period relative to the reference period, rather than decreasing as predicted by Ruge-Murcia (2006). Coefficients in the ZLB period may be driven by two particular episodes. On the one hand, in 2003–2004, short rate increases from very low levels may have had a big effect on long-term yields, signalling the beginning of a monetary policy tightening cycle. On the other hand, short rate decreases in 2011 (when short rates had already reached low levels) may still have had strong effects on long-term yields because they were expected to be very persistent due to external environment (strong Swiss franc, on-going European debt crisis).

Second, in the floor period, the coefficient on positive short rate changes drops sharply, even turning slightly negative. The coefficient on negative short rate changes drops as well, but remains positive. On the one hand, there were only a limited number of (small) positive short rate changes during this period. These perhaps reflected “noise” rather than new information relevant for future interest rates, and therefore were not associated with changes in long-term yields. On the other hand, the effect of negative short rate changes may have remained statistically significant because these reflected a safe-haven demand for CHF assets, driving down long-term yields and to a lesser extent also short-term rates.

Third, the coefficients increase again in the NIR period relative to the floor period, even becoming larger than during the reference period. One potential explanation would be that market beliefs about the level of the lower bound dropped more strongly than short-term interest rates (i.e., by more than 75 basis points), so that despite the introduction of deeply negative policy rates, the proximity to the market-perceived lower bound increased. However, the finding that coefficients in the NIR period are larger than in the reference period remains puzzling.

Robustness

Additional control variables and alternative measures for long-term rates

The overview of recent changes in Swiss monetary policy implementation in the “Swiss monetary policy implementation” section suggests a number of necessary robustness checks. In particular, we want to make sure that the results are not driven by additional factors that could be correlated with monetary policy and that the results are robust to the choice of interest rates.

During the period that we study in this paper, the SNB intervened on the FX market to counter appreciation pressure on the Swiss franc. These unsterilized FX interventions were associated with increases in central bank reserves. In contrast to a classical Quantitative Easing program where the central bank buys domestic bonds, the SNB’s foreign currency purchases did not directly influence CHF interest rates. Nevertheless, as argued in the “Theoretical motivation” section, SNB balance sheet expansions due to unsterilized FX interventions could have indirectly affected the link between short- and long-term interest rates via several alternative mechanisms. To control for such effects, we include the change in the level of central bank reserves as an additional control variable in regression (1).

Short-term interest rates can spike at month ends or at the end of a minimum reserve requirement (mire) period, as banks require short-term funding on such dates. Portfolio rebalancing operations at month ends may also affect long-term yields. To control for such effects, indicator variables for days at the end of a month and the end of a minimum reserve requirement period are included. Additionally, dummies for dates of monetary policy decisions are included to control for expected monetary policy changes. Finally, we control for measures of global financial market risk aversion, using first differences of the VIX index, to pick up risk premium movements. Global risk aversion is likely to affect Swiss term premia through safe-haven demand (negative) as well as through risk premiums directly (positive), and we do not know a priori what sign to expect.

We also try alternative measures of long-term interest rates. First, we use the fixed leg of interest rate swaps (IRS) in place of government bond yields in the baseline specification. As for OIS rates and Swiss government bond yields, we use end-of-day data for IRS rates, i.e., last prices available on Bloomberg, usually traded between 6 and 7 p.m. CET. Second, we use the popular term structure model of Adrian et al. (2013) to split Swiss government bond yields into expected average future short-term interest rates and a residual (the term or liquidity premium)Footnote 10. We then use the estimated expected average short-term rates as dependent variables in our regressions. We consider this to be a useful innovation relative to previous empirical work: the nonlinearities predicted by the Ruge-Murcia (2006) model rely purely on the expectations hypothesis of the term structure, so that changes in term premia in this context represent “noise” that makes it more difficult to identify these nonlinear effects in the data.

Tables 3 and 4 in the Appendix present an overview of the robustness tests with additional control variables and the use of IRS as dependent variable. The results from the baseline regression are robust to these alternative specifications: in the baseline period, both coefficients are positive and in most cases statistically significant but not significantly different from each other. The impact of changes in short-term rates decreases with the maturity of the long-term interest rates. During the ZLB period, the coefficients for positive changes in short-term rates increase substantially, while those for negative changes in short-term interest rates either remain unchanged or even become statistically insignificant when controlling for additional variables. In the floor period, the coefficients for positive changes in short-term rates become insignificant, while those for negative changes become significant again. The difference between the two is now significantly different from zero. In the NIR period, the coefficients normalize again and approach the levels of the reference period. The transmission of short-term to long-term interest rates thus seems to work better than during the previous two periods. First, the coefficient for positive changes in short-term interest rates becomes statistically significant. Once again, the null hypothesis that β1=β2 cannot be rejected. Second, as in the reference period, the effect of short-term interest rates on long-term interest rates declines with the maturity of the long-term yield.

The additional control variables are rarely statistically significantFootnote 11. Changes in the amount of SNB sight deposits show a significant although very small negative impact in the ZLB and NIR periods. An increase in sight deposits thus leads to a decrease in long-term interest rates with a maturity of up to 5 years. Balance sheet increases, notably due to foreign exchange interventions or liquidity expansions, are thus associated with a decrease in long-term yields, which is also consistent with a term premium effect of such measures as identified in Christensen and Krogstrup (2015). Furthermore, the dummy capturing SNB policy decisions exhibits a positive significant coefficient in the NIR period, indicating an additional decrease in long-term interest rates when the policy rate was cut. The VIX index has a statistically significant but economically small effect in the ZLB period, with Swiss long-term yields declining when then VIX index increases. The effect of the index reflects the safe-haven status of Swiss government bonds.

Table 5 in the Appendix presents the results when using expected average short-term rates as dependent variables. The results are consistent with those from the baseline specification. Adjusting for the term premium reduces the coefficients in the NIR period, which are now more in line with the reference period. Again, this suggests that the transmission from short- to long-term interest rates worked well in the NIR period. In contrast, in the ZLB period, coefficients for positive changes in short-term rates remain elevated, indicating once more that the transmission was weaker than in the reference and the NIR periods.

Accounting for outliers

The results above show marked differences in the relationship between changes in short- and long-term interest rates across subsamples, and in particular between the reference period and later periods in which interest rates were very low. One might wonder whether these differences are driven by a decline in interest rate volatility, since periods of low interest rate levels tend to be periods where interest rate volatility is low. In fact, absolute changes in 3-month Swiss franc OIS rates, the right-hand side variable in our regressions, tend to be small throughout the sample. The mean absolute daily change over the whole sample period is only 0.2 basis points, and the standard deviation 2.5 basis points. However, when interest rate levels are higher, there are more observations (although still relatively few) of larger absolute interest rate changes. Perhaps, the uneven distribution of these outliers across subsamples is driving the results?

To investigate this, we define outliers as observations where the absolute daily change is larger than 2 standard deviations, i.e., 5 basis points, and exclude these outliers from our baseline regression. We also include additional control variables as in the previous section. Table 6 in Appendix reports the results. The regression coefficients do not materially change compared with the baseline results in Table 1. The coefficients keep their signs and remain at similar levels. This suggests that the differences in coefficients across subsamples are not driven by changes in interest rate volatility. However, some coefficients lose statistical significance when outliers are excluded, especially in the floor and NIR period. This is not surprising since we are missing the information provided by large interest rate movements. Coefficients typically remain statistically significant at the 10% level.

An alternative specification

The Ruge-Murcia (2006) model predicts that longer-term yields respond more strongly to positive than negative short rate changes, at a given interest rate level. Our baseline regressions, following the earlier empirical literature, tried to capture this effect by considering subsamples such that within each sample, short-term interest rates are either well above zero (where lower bound effects would not be expected to matter much anyway) or exhibit only small changes at low levels. An empirical approach that perhaps more accurately captures the effects predicted by the theory is to introduce an interaction term with the (lagged) interest rate level—as a measure of the extent to which the lower bound is binding—and short rate changes. We consider the following regression specification as an alternative to the baseline specification:

where \( (r_{t-1}-\bar {r}_{t-1})\) denotes the difference between the level in short-term interest rates and the observed lower bound in interest ratesFootnote 12. We estimate this specification over the whole sample period using 3-month OIS rates as measure of the short term interest rate (as in the baseline specification), adding the same control variables as used in “Additional control variables and alternative measures for long-term rates” section. According to the model, β1 and β2 are expected to be positive. That is, the effect of short-term interest rates on long-term interest rates should increase with the distance of interest rates from their lower bound.

Table 2 shows the results for different maturities of government bond yields, which are in line with the previous findings. β2 is positive and statistically highly significant. The magnitude of β2 is comparable with the average of β1 and β2 in the baseline specification: a change in the short-term interest rate by one basis point implies a change in the long-term rate of roughly 0.3–0.4 basis point. The impact tends to decrease with the duration of the long-term rate. The coefficients for the interaction term, β1, are negative, but small and statistically significant at the 10% level for only five of seven maturities. Therefore, the effect of changes in short-term rates on long-term yields decreases with the interest rate level. This is in line with the results presented before, but at odds with the theory.

Conclusions

This paper studies the transmission of changes in short-term interest rates to longer-term government bond yields when short-term rates are close to zero or negative, focusing on Switzerland. While standard term structure models predict that the impact of short rate changes on longer-term yields should decline as interest rates approach the lower bound, we instead find for Swiss data that this effect was larger during much of the lower bound period than during the pre-crisis period. During the period where short-term interest rates are close to zero, the transmission of short-term interest rates becomes asymmetric—positive changes in short-term interest rates have a larger impact on long-term interest rates than negative changes in short-term interest rates. This finding is in line with the theory, although quantitatively larger than expected. Since the SNB has implemented negative interest rates on sight deposits, the strength of this asymmetry has decreased again, suggesting that the transmission from short-term interest rates to long-term interest rates improved.

In this paper, we focus on the day-to-day comovements of short- and long-term interest rates, rather than just on the impact of policy rate changes after SNB policy decisions. Therefore, our results cannot directly be interpreted with respect to the strength of the transmission of policy rate changes. Nevertheless, our findings are at least consistent with the following interpretation. First, the transmission of short rate cuts to longer-term yields works in negative territory. Second, as short rates are normalized after a period close to the lower bound—as observed between fall 2008 and fall 2011—positive changes in short-term interest rates may have unusually strong effects, and long-term interest rates may adjust very quickly to changes in the policy rate.

Appendix

Robustness checks

Notes

The Swedish central bank introduced negative interest rates to its deposit facility in 2009 for a short time period, which was not binding for money markets.

Lemke and Vladu (2017) discussed this nonlinearity in the context of a more complex shadow rate term structure model that is estimated for the euro area.

See Kettemann and Krogstrup (2014) for an overview of these new measures and an analysis of the SNB’s covered bond purchase program in 2009–2010.

See Christensen and Krogstrup (2015) for an analysis of the impact of these measures on interest rates.

To absorb the liquidity created in the foreign exchange interventions, the SNB conducted liquidity-absorbing repo operations between July 2010 and August 2011. With the introduction of the minimum exchange rate, the SNB again conducted minor liquidity-providing repo operations until April 2012.

Lemke and Vladu (2017) and Grisse et al. (2017) generalize Ruge-Murcia’s model by allowing for a varying and possibly non-zero lower bound on the short-term nominal interest rate. This allows them to study the effects of changes in the market-perceived lower bound.

For details on this transmission mechanism, see for example the SNB’s 2016 accountability report, page 46, available at https://www.snb.ch/en/iabout/pub/annrep/id/pub_annrep_2016.

See the SNB press release from 3 August 2011.

For more information on Libor, see https://www.theice.com/iba/libor.

We thank Benjamin Brunner for making these estimates available. The term structure model is estimated using the 1-year IRS rate as measure of the short-term interest rate.

Details are available from the authors upon request.

The lower bound \(\bar {r}_{t}\) is defined as the lowest policy rate level ever set among major central banks up to date t, see Grisse et al. (2017).

References

Adrian, T, Crump, RK, Mönch, E (2013). Pricing the term structure with linear regressions. Journal of Financial Economics, 10(1), 110–138.

Bech, ML, & Malkhozov, A (2016). How have central banks implemented negative policy rates?BIS Quarterly Review, 31–44.

Christensen, JHE, & Krogstrup, S (2015). Transmission of quantitative easing: the role of central bank reserves. SNB working paper, 2015–06.

Christensen, JHE, & Krogstrup, S (2016). A portfolio model of quantitative easing. SNB working paper, 2015–19.

Grisse, C (2015). The zero lower bound and movements in the term structure of interest rates. Economics Letters, 131, 66–69.

Grisse, C, Krogstrup, S, Schumacher, S (2017). Lower bound beliefs and long-term interest rates. International Journal of Central Banking, 13, 165–202.

Guggenheim, B, Kraenzlin, S, Schumacher, S (2011). Exploring an uncharted market: evidence on the unsecured Swiss franc money market. Aussenwirtschaft, 66, 59–87.

Kettemann, A, & Krogstrup, S (2014). Portfolio balance effects of the Swiss National Bank’s bond purchase program. Journal of Macroeconomics, 40, 132–149.

Lemke, W, & Vladu, AL (2017). Below the zero lower bound: a shadow-rate term structure model for the euro area. ECB Working Paper No. 1991.

Ruge-Murcia, FJ (2006). The expectations hypothesis of the term structure when interest rates are close to zero. Journal of Monetary Economics, 53(7), 1409–1424.

Swanson, ET, & Williams, JC (2014). Measuring the effect of the zero lower bound on medium- and longer-term interest rates. American Economic Review, 104(10), 3154–3185.

Acknowledgements

We thank Katrin Assenmacher, Benjamin Brunner, Matthias Jüttner, Signe Krogstrup, Wolfgang Lemke, Eric Swanson, Martin Brown (the editor), and an anonymous referee for helpful comments and suggestions. We are also grateful for the comments from seminar participants at the Joint ECB-IMF Workshop on Money Markets, Monetary Policy Implementation and Market Infrastructures in October 2016, the Annual Congress 2016 of the Swiss Society of Economics and Statistics and an SNB Brown Bag Workshop. The views expressed in this paper are those of the authors and do not necessarily reflect the position of the Swiss National Bank.

Author information

Authors and Affiliations

Contributions

Both authors read and approved the final manuscript. Both authors contributed equally to the article.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Grisse, C., Schumacher, S. Term structure dynamics at low and negative interest rates—evidence from Switzerland. Swiss J Economics Statistics 154, 20 (2018). https://doi.org/10.1186/s41937-018-0022-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s41937-018-0022-2